Getting paid for the work we do as freelancers is a topic I take seriously. According to a study by the Independent Economy Counsel, 75% of freelancers do not get paid on time. Even worse, 59% of respondents were owed $50,000 or more for work already completed!

As someone who relies on freelance income to make a living, I find this statistic appalling. That’s why I’m sharing how to remind someone to pay you without making it awkward, and how to prevent late payments in the first place.

I’ll share a template for writing simple, effective reminders while remaining respectful and professional. From understanding your rights as a freelancer to setting up automated payment systems and using the right language in your messages, you’ll learn how to make getting paid easy and painless!

How to remind a freelance client to pay you

When it comes to reminding freelance clients to pay you, being proactive is key. Too many freelancers avoid sending payment reminders, letting their frustration grow with each passing day. Sending payment reminders in a timely, consistent manner helps you avoid those awkward conversations in the first place.

Start by sending an invoice immediately following the completion of a project, then follow up with a polite reminder a week later if no payment has been made. When sending reminder emails, remain professional and courteous, while still conveying your need for prompt payment.

Include all relevant details such as invoice number and amount due in this reminder, so clients know exactly what they’re paying for. Additionally, make sure your contact information is visible on all communications so that clients have easy access to any follow-up questions they might have.

Step 1: Use invoicing software to automate reminders

Payment reminders become so much easier when you automate them. With all the free software options available today, you’re wasting valuable time (and emotional energy) if you’re still invoicing and following up manually.

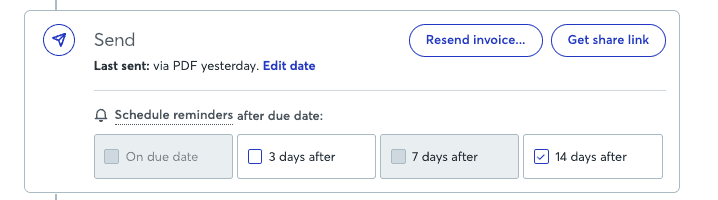

Invoicing software like Wave and Freshbooks sends automated payment reminders to your customers. With these tools, you no longer need to manually send emails or make phone calls. You can simply set up a reminder schedule in the app and let the software take care of it.

Most apps also allow you to customize payment reminders with personal touches, so they don’t sound overly formal or robotic. This helps build rapport with clients and lets them know that you value their business relationship as well as their timely payments.

^^I use Wave in my freelance business and love that custom invoice reminders are so easy to set up.

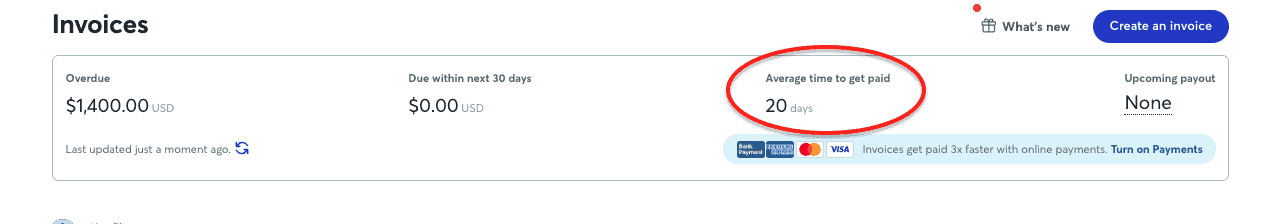

^^Wave also averages the payment dates of all your invoices so you know your average payment turnaround time. This is important not only for budgeting but also for reducing your average payment time.

Step 2: Make it as easy as possible for clients to pay you

When it comes to reminding a freelance client to pay you, the key is to make it as easy and convenient as possible for them. Does your process require clicking a few buttons or does it require the client to jump through hoops?

Use Stripe or Paypal

Utilizing payment systems like Stripe and PayPal allows you to accept payments online without having to send physical invoices. The only downside to payment processors is that you will pay transfer fees. Stripe charges 2.9% + 30¢ per successful card charge and PayPal charges 2.99% + 49¢

Keep your payment instructions front and center

Make sure your payment terms are clearly stated on your invoices, price sheet, and proposals so that clients know when payments are due. This helps avoid confusion or misunderstandings about when or how much money is owed. The more information provided upfront about the payment process, the better.

Note: I prefer receiving payments from my clients via direct deposit. While this may take longer to set up on the front-end, it ensures I get paid quickly without fees in the future.

Step 3: Maintain professional client communication

Asking for money is never comfortable, but it doesn’t have to be an awkward experience. How you follow up on invoices leaves a lasting impression on your client so you want to stand firm but also remain friendly. Here’s how:

- Give them the benefit of the doubt

Late payments aren’t always intentional. Your clients could simply forget, have an emergency, or have a technical issue with their payroll. That’s why I advise keeping your first message as polite as possible.

Send them a short email reminding them of the overdue invoice and give them a new deadline for payment. Clients will usually take it as an opportunity to tell you it slipped their minds and will pay without making it awkward.

On the other hand, if your tone is accusatory, you may be met with defensiveness and ultimately ruin the relationship.

- Remain polite

To remain polite (but professional) use the subject line “Friendly invoice reminder” and use warm language to avoid making the client feel “wrong.” If the client becomes unresponsive or months late, you will eventually become sterner, but you should always start off friendly.

-

Remember that it’s business, not personal.

When clients are late on payments or refuse to pay, it’s easy to get frustrated and want to confront them. However, I urge you to keep a professional attitude throughout all your interactions with clients, even if you’re about to file a lawsuit. Despite feeling wronged, remember you have a professional reputation to uphold.

Speaking professionally, using clear and concise language, listening to their perspective, and responding respectfully even if they disagree with you are all best practices for client communication. In other words, keep it classy!

Step 4: Safeguard against clients who don’t pay

While you can’t control if clients pay on time, there are steps you can take to safeguard yourself. Follow these steps before doing business with clients, and you’ll increase the chances of receiving the timely pay you deserve for your hard work and avoid chasing unpaid invoices.

- Document your payment schedule and process

Make sure that your payment terms are clearly stated on your invoices, price sheet, and proposals so that clients know when payments are due. I state my terms on the initial call, in the follow-up email, and withinl my agreements and documents.

The goal is to get the client to acknowledge and agree to your payment terms. Include the term “Net 15” or “Net 30” which is accounting-speak for your payment deadlines.

2. Get verbal and written agreement for your terms

To protect yourself from payment issues, the client should agree to your payment terms in writing before beginning any freelance engagement. Without formal contracts, you’re at the mercy of the client and their ability to remember the details of your working arrangement.

The result of not safeguarding yourself with a legally binding contract is usually confusion and disputes over money that could have been avoided if terms had been agreed upon in advance.

Written agreements also make it easier to follow up on late payments because you can refer to the original agreement when sending reminders. Having explicit payment terms also sets clear expectations for all parties involved, which helps prevent misunderstandings and potential conflicts in the future.

Here’s an example of the payment clause in my freelance contract:

Services Fees. Compensation for the Services will be set forth in each applicable Statement of Work made pursuant to this Agreement (“Services Fees“). Unless otherwise specified, Services Fees will be invoiced to Client monthly and shall be paid within fifteen (15) days of Client’s receipt of an invoice from B2B Tech Writing. Services Fees are non-terminable and payments are non-refundable upon payment to B2B Tech Writing.

3. Require a deposit

You can protect yourself from clients who may not pay on time (or at all) by charging a 50% deposit before beginning any work. By asking for payment upfront, you ensure that you’ll receive some compensation for the job even if the client decides not to pay for the full amount.

Not only does it give you a financial buffer in case something goes wrong, but it also creates incentives for clients to pay promptly when you bill for the remaining balance. Don’t be intimidated by charging a deposit. It sends a strong signal that you take your business seriously and expect professionalism from your clients too.

4. Charge interest on late payments

Yes, as a freelancer, you should consider charging interest on late payments. The added costs can be a powerful motivator to prevent future late payments by clients who fail to meet their contractual obligations.

Interest fees will also help you recoup some of your losses due to unpaid invoices. Furthermore, discussing the interest payment terms with clients upfront makes it clear that freelance services are not free and that you expect prompt payment.

Here’s an example of the interest charge language in my freelance contract:

Overdue Charges. Late payments shall bear interest at the lesser of the rate of 5% per month or the highest rate permissible under applicable law, calculated daily and compounded monthly. Client shall also reimburse B2B Tech Writing for all reasonable costs incurred in collecting any late payments, including, without limitation, attorneys’ fees.

5. Always have a financial safety net

Invoicing in general may feel extra stressful if you’re low on cash. You want the peace of mind that late payments will not result in financial disaster for you in the event that your clients don’t pay on time.

Having a safety net helps you remove some of the emotion and avoid desperation so you can continue your other business activities without pressure.

Step 5: Send a reminder of payment email using this template

If all else fails, you should manually send a letter reminding your freelance client to pay you. Use this template to remain polite, and professional, and prevent awkward conversations.

Subject: [Your Name or Business Name]: invoice [invoice reference number]

Hi [Name],

Hope you’re well!

Wanted to drop you a quick note to remind you that [amount owed] in respect of our invoice [invoice reference number] was due for payment on [date due].

Can you please let me know when I can expect to receive payment?

Thank you,

[Your Name]

If your client ghosted you or refuses to pay, I have more templates to help you get paid here: The Freelance Template Playbook!

Step 6: Pursue legal action or cut your losses

If your polite payment reminders continue to fall on deaf ears and you’ve exhausted all of your options for getting the client to pay, it may be time to pursue legal recourse. First, consult with a lawyer to determine if you have a case. A lawyer will advise you on the best course of action based on your situation.

Depending on the amount of money owed, state laws, and other factors, you may need to file a claim in small claims court or take more serious legal action. While the timeline for this process varies depending on the jurisdiction in which you live and work, it could take several weeks or months before a judgment is reached.

Unfortunately, pursuing legal recourse can be expensive and time-consuming, so it should always be used as a last resort after all other attempts at collecting payments have been unsuccessful. In my opinion, it may not be worth the cost of pursuing legal action unless you’re owed more than $5,000.

If you’re looking for a lawyer specializing in contracts, I highly recommend Greg Butler.

The bottom line on reminding someone to pay you

Reminding someone to pay you doesn’t have to be awkward or uncomfortable. By automating your invoice reminders, making payments frictionless, and using the right tone in your emails, you increase the chances of getting paid and salvaging the relationship with the client.

With consistent communication and well-documented payment terms, freelancers can prevent payment issues and navigate the tricky waters of outstanding invoices with ease. Most importantly, remember that you are entitled to your money. Don’t be afraid to assert yourself if necessary!

If you want more freelance payment reminder templates (plus 35 client scenarios), check out The Freelance Template Playbook!

Let's Connect!